Video Streaming Software Market by Offering (Solutions, Services), Streaming Type (Live Streaming, Video-on-Demand Streaming), Deployment Mode, Delivery Channel, Monetization Model, Connected Device, Vertical and Region - Global Forecast to 2029

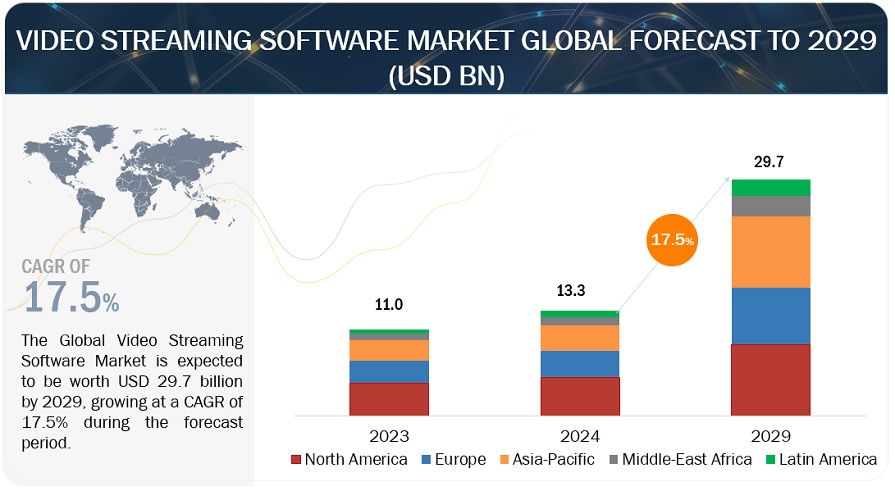

[326 Pages Report] The video streaming software market is expected to grow from USD 13.3 billion in 2024 to USD 29.7 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 17.5% during the forecast period. The global video streaming software market continues to experience robust growth, driven by increasing internet penetration, rapid adoption of smartphones and smart TVs, and the rising demand for on-demand entertainment. The COVID-19 pandemic has further accelerated the growth of this market, as lockdowns and social distancing measures led to a surge in online streaming consumption. However, the market faces economic uncertainties from geopolitical tensions, inflationary pressures, and rising interest rates. Despite these challenges, the market is expected to witness sustained growth in the coming years, driven by technological advancements, expanding content libraries, and the proliferation of subscription-based models.

Technological integration plays a pivotal role in shaping the landscape of the video streaming software market, driving innovation, enhancing user experiences, and expanding the capabilities of streaming platforms. One of the most notable advancements is the integration of artificial intelligence (AI) and machine learning (ML) algorithms, which enable content recommendation, personalization, and predictive analytics. These technologies analyze user behavior, preferences, and viewing patterns to deliver tailored content suggestions, improving engagement and retention rates. Moreover, AI-powered video analytics offer valuable insights into audience demographics, content performance, and advertising effectiveness, empowering streaming services to optimize their offerings and monetization strategies. Additionally, adopting cloud-based infrastructure facilitates scalability, flexibility, and cost-efficiency, allowing streaming platforms to handle large volumes of data and traffic seamlessly. Furthermore, the integration of immersive technologies such as virtual reality (VR) and augmented reality (AR) is poised to revolutionize the streaming experience, offering immersive storytelling and interactive content formats.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Video Streaming Software Market

The combined impact of the COVID-19 pandemic, the Russia-Ukraine conflict, inflation, and rising interest rates have created significant challenges for the global video streaming software market, particularly amidst economic downturns and recessions. The pandemic initially led to a surge in demand for video streaming services as people turned to digital entertainment and remote work solutions during lockdowns. However, the economic fallout from COVID-19 and geopolitical tensions such as the Russia-Ukraine conflict have created uncertainty and volatility in financial markets. Inflationary pressures and rising interest rates reduced consumer spending and tighter business budgets. As a result, companies may cut back on discretionary expenses, including investments in video streaming software and infrastructure. Additionally, advertising revenues, a key source of income for many streaming platforms, could decline as businesses scale back marketing budgets in response to economic challenges. Thus, the recession has a moderate impact on the global video streaming software market.

Video streaming software market Dynamics

Driver: Increasing demand for VOD streaming

VOD services allow users to conveniently access a vast content library without adhering to traditional broadcast schedules. This flexibility has led to a surge in demand for VOD streaming platforms, driving the development of innovative video streaming software solutions to meet evolving consumer preferences—the rapid expansion of subscription-based platforms such as Netflix, Amazon Prime Video, and Disney+.

These platforms offer a wide range of on-demand content, including movies, TV shows, documentaries, and original programming. In response to the growing demand for VOD streaming, video streaming software vendors have developed a range of products tailored to the needs of content creators, broadcasters, and streaming platforms. For instance, software solutions such as Brightcove, JW Player, and Kaltura offer comprehensive VOD streaming capabilities, including content management, transcoding, monetization, and analytics. These platforms empower content creators to deliver high-quality on-demand video experiences across various devices and platforms, driving user engagement and revenue generation. Additionally, the adoption of VOD streaming has expanded beyond traditional entertainment to sectors such as education, healthcare, and enterprise. For instance, educational institutions leverage VOD platforms such as Panopto and Enghouse Systems to deliver online courses and training materials to students and employees,

Restraint: Cost of content creation and issues with Piracy

The cost of creating high-quality video content, including original programming, movies, and TV shows, can be substantial. Content creators and streaming platforms face significant investments in production, licensing, talent acquisition, and marketing to develop compelling content that attracts and retains viewers. These high production costs can act as a barrier to entry for new players in the market and may limit the availability of premium content on streaming platforms.

Additionally, Piracy undermines the revenue potential of legitimate streaming services by offering unauthorized access to copyrighted content for free or at a fraction of the cost. Pirated content deprives content creators of revenue, erodes consumer trust, and undermines the value proposition of licensed streaming services. The proliferation of illegal streaming sites and file-sharing platforms makes it difficult for streaming platforms to combat Piracy effectively, despite efforts to implement digital rights management (DRM) and anti-piracy measures. While technological solutions such as advanced DRM systems and content watermarking can help deter Piracy to some extent, the cost and complexity of implementing these measures can be prohibitive for smaller streaming platforms.

Opportunity: Emergence of 5G technology

5G technology offers significant opportunities for the adoption and evolution of video streaming software, revolutionizing how content is delivered, consumed, and monetized. 5G has ultra-fast download and upload speeds, significantly reducing latency and enabling seamless streaming of high-definition and even 4K video content on mobile devices. For instance, with 5G, users can stream high-quality videos on the go without experiencing buffering or delays, enhancing the overall viewing experience. The support of the 5G edge computing capabilities could revolutionize video streaming by bringing processing power closer to the end user. Streaming platforms can reduce latency and optimize content delivery by deploying edge servers at the network edge, ensuring smooth playback and minimizing buffering; this enables streaming platforms to deliver high-quality video experiences to users in real-time, even in congested network environments. According to a report by Ericsson, it is estimated that 5G subscriptions will reach 3.5 billion by the end of 2026, representing around 40% of all mobile subscriptions. This widespread adoption of 5G technology underscores its significant impact on the video streaming industry, providing ample opportunities for innovation, growth, and enhanced user experiences.

Challenge: Data security and privacy concerns

Video streaming platforms face various security challenges, including content piracy, data breaches, unauthorized access to user data, and malicious attacks targeting streaming infrastructure. Content creators and rights holders are particularly vulnerable to Piracy, as unauthorized distribution of copyrighted content results in financial losses and undermines the integrity of their intellectual property rights. Moreover, collecting and storing user data by streaming platforms raises privacy concerns, as users may risk having their personal information compromised or misused. In response to these threats, streaming platforms and content creators invest in advanced security measures, such as encryption, digital rights management (DRM), watermarking, and content moderation tools, to protect against unauthorized access and Piracy. Additionally, regulatory bodies are increasingly scrutinizing data privacy practices in the streaming industry, leading to stricter compliance requirements and regulations to safeguard user privacy and ensure data security.

Video Streaming Software Market Ecosystem

Based on connected devices, the mobile devices segment will record the highest market share in 2024.

Mobile devices have become central to the video streaming software market, with smartphones and tablets as primary platforms for accessing digital content on the go. The Netflix mobile app lets users stream a vast library of movies and TV shows directly on their smartphones or tablets. Users can create personalized profiles, receive recommendations based on their viewing history, and download content for offline viewing, making it a popular choice for mobile streaming. Another instance where TikTok has emerged as a dominant force in short-form video content, with its mobile app allowing users to create, share, and discover short videos ranging from comedy sketches to lip-sync performances. With its addictive feed, personalized recommendations, and viral challenges, TikTok has become a cultural phenomenon, driving significant engagement on mobile devices. Further, wearable devices are increasingly integrated into broader wearable ecosystems, enabling seamless connectivity and interoperability with smartphones, tablets, and smart home devices. For example, smartwatches can control video playback on streaming apps installed on smartphones, providing users with a unified entertainment experience across multiple devices.

Based on streaming type, the live streaming segment will grow at a higher CAGR during the forecast period.

Live streaming is a dynamic and increasingly popular feature within the video streaming software market, offering users the ability allowing users to broadcast real-time video content over the internet to a global audience. This technology has witnessed exponential growth in recent years, fuelled by advancements in internet infrastructure, the proliferation of mobile devices, and the rise of social media platforms. Live streaming has become a dominant force in the digital landscape, with platforms like Twitch, YouTube Live, and Facebook Live experiencing significant user engagement and viewership numbers. For instance, Twitch, a leading live-streaming platform for gamers, reported an average of over 2.45 million concurrent users in 2023. Similarly, YouTube Live has seen a surge in live streaming activity, with content creators and brands leveraging the platform to host live events, product launches, and Q&A sessions. In addition to entertainment and gaming, live streaming has been widely adopted in various other domains, including sports, news, education, and e-commerce. Major sports leagues and broadcasters have embraced live streaming to reach global audiences and enhance fan engagement, with live sports events accounting for a significant portion of online streaming traffic. Moreover, the COVID-19 pandemic has accelerated the adoption of live streaming across industries, as organizations and individuals turned to virtual events and remote communication solutions to maintain connectivity and continuity amidst lockdowns and social distancing measures

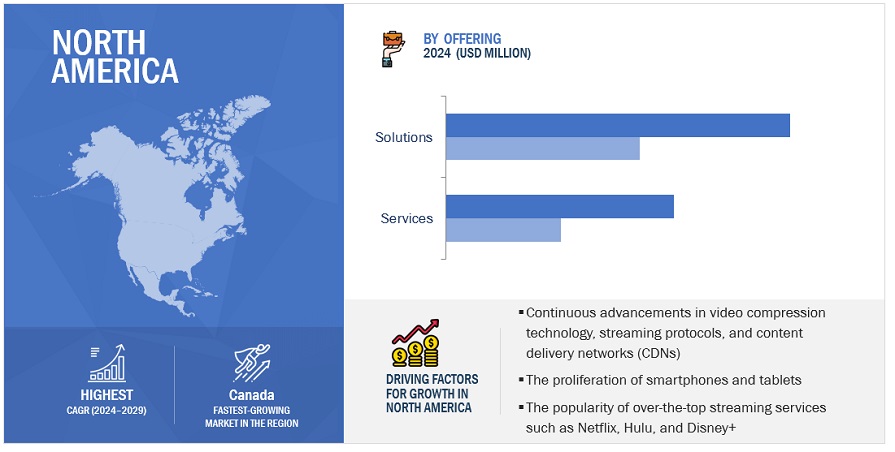

Based on region, North America holds the largest market share during the forecast period.

North America is witnessing rapid growth in the video streaming software market due to technological advancement and increasing demand for online streaming content. The large video streaming software industry companies belong to North America, making it the largest provider of solutions, products, and services. North America accounts for a significant share of the global video streaming software market, with key players such as Netflix, Amazon Prime Video, Disney+, Hulu, and others shaping the landscape. Netflix has adopted AI integration to provide personalized experiences to users. Google has come up with CDN tools for media streaming. The US and Canada are the top contributors to the video streaming software market in the region. The new developments and enhancements in video streaming services, such as interactive videos and personalized video content, have increased the demand for video streaming.

According to Bank of America, despite the rising subscription cost, more households are spending over USd 100 monthly on streaming. The percentage of households making monthly streaming payments rose by over four percentage points in January 2024 compared to the same period in 2021. Key factors driving this rapid growth include advancements in personalization and AI technologies, the rising popularity of live streaming, global efforts in content licensing, the adoption of higher quality 4K and 8K streaming, and the evolution of interactive content experiences.

Key Market Players

The video streaming software market is dominated by a few globally established players such as IBM (US), Brightcove (US), Kaltura (US), Edgio (US), Vimeo (US), Agile Content (Spain), Haivision (Canada), Panopto (US), Enghouse Systems (Canada), Akamai (US), Netgem Group (France), Dailymotion (France), Hive Streaming (Sweden), Blue Billywig (Netherlands), JW Player (US), Wowza (US), Vbrick (US), movingimage (Germany), VIDIZMO (US), Kollective Technology (US), Dacast (US), MediaPlatform (US), CONTUS TECH. (US), VIXY (Netherlands), uStudio (US), Vidyard (Canada), SproutVideo (US), Castr (Canada), and Muvi (US), among others, are the key vendors that secured video streaming software contracts in the last few years. These vendors have global and local presence in the video streaming software market. The video streaming software market is witnessing significant growth, driven by evolving learning needs, technological advancements, and the increasing adoption of digital streaming solutions across various industries. Vendors are focusing on continuous product innovation to differentiate themselves in the market; this includes developing user-friendly interfaces and incorporating advanced features such as AI-driven live and on-demand video streaming solutions and mobile-based video streaming software solutions to offer enhanced customer service.

Scope of Report

|

Report Metrics |

Details |

|

Market Size Available For Years |

2019–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Streaming Type, Deployment Mode, Delivery Channel, Monetization Model, Connected Devices, Vertical, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

IBM (US), Brightcove (US), Kaltura (US), Edgio (US), Vimeo (US), Agile Content (Spain), Haivision (Canada), Panopto (US), Enghouse Systems (Canada), Akamai (US), Netgem Group (France), Dailymotion (France), Hive Streaming (Sweden), Blue Billywig (Netherlands), JW Player (US), Wowza (US), Vbrick (US), movingimage (Germany), VIDIZMO (US), Kollective Technology (US), dacast (US), MediaPlatform (US), CONTUS TECH. (US), VIXY (Netherlands), uStudio (US), Vidyard (Canada), SproutVideo (US), Castr (Canada) and Muvi (US). |

This research report categorizes the video streaming software market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

- Solutions

- Transcoding & Endcoding

- Video Hosting

- Video Content Management

- Video Analytics

- Video Security

- Other Solutions

- Services

- Professional Services

- Consulting

- Integration & Implementation

- Support & Maintenance

- Managed Services

By Streaming Type:

- Live Streaming

- Video-On-Demand Streaming

By Monetization Model:

- Subscription-Based

- Advertising-Based

- Transaction-Based

By Deployment Mode:

- Cloud

- On-premises

By Connected Devices:

- Streaming Sticks & Media Players

- Mobile Devices

- Other Devices

By Delivery Channel:

- Web-based Delivery

- Mobile App Delivery

By Vertical:

- Media & Entertainment

- BFSI

- Academia & Education

- Healthcare

- Government

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In April 2024, Accedo and Brightcove, with Al Sharqiya Group, launched Iraq's first SVOD platform to enhance the 1001 OTT service, offering ad-free premium content alongside live linear channels. Initially an AVOD service, 1001 caters to global Arabic-speaking audiences with localized content in Arabic and English, featuring collaborations with OSN+, Rotana, and StarzPlay to deliver an extensive on-demand catalog. This partnership pioneers innovative, customer-centric media solutions in the Middle East.

- In 2023, Kaltura's Cloud TV and Streaming Platform launched enhancements for its TV operators and media customers, improving user experience and boosting revenue with personalized add-ons. These enhancements include Business Insight for data-driven decisions, Shop-in-Shop for content management, and advanced monitoring tools for real-time system control, empowering customers to expand services and drive revenue growth in cloud TV.

- In January 2023, IBM announced enhancements to its video streaming software, including features such as customizing event registration forms with dynamic fields based on user selections and improving data collection. Update published event registration forms seamlessly without unpublishing them first, ensuring uninterrupted registration processes.

- In June 2022, Edgio announced the successful completion of Limelight's acquisition of Edgecast. The combined company operates as Edgio, delivering significantly increased scale and scope with diversified revenue across products, clients, geographies, and channels and an expanded total addressable market of USD 40 billion.

Frequently Asked Questions (FAQ):

What is a Video Streaming Software?

Video streaming: "Video streaming enables enterprises to continuously deliver video data to a remote user over a network or the internet. A streaming provider offers various hosting options, such as on-premises and cloud-based, to meet users' needs. Video content such as TV shows, movies, and live streams is delivered on-demand or via live broadcast, usually from a cloud-based network. The video streaming software empowers enterprises to create, store, manage, monitor, and share video content across their systems for internal communication or to present the information externally to a live audience. With different streaming types, such as on-demand or live-stream videos, customers can select and watch content with the help of web-based and mobile app-based delivery channels.

Which country was the early adopter of Video Streaming Software solutions?

The US was at the initial stage of the adoption of video streaming software solutions.

Which are the key vendors exploring Video Streaming Software Solutions?

Some of the significant vendors offering video streaming software solutions across the globe include IBM (US), Brightcove (US), Kaltura (US), Edgio (US), Vimeo (US), Agile Content (Spain), Haivision (Canada), Panopto (US), Enghouse Systems (Canada), Akamai (US), Netgem Group (France), Dailymotion (France), Hive Streaming (Sweden), Blue Billywig (Netherlands), JW Player (US), Wowza (US), Vbrick (US), movingimage (Germany), VIDIZMO (US), Kollective Technology (US), dacast (US), MediaPlatform (US), CONTUS TECH. (US), VIXY (Netherlands), uStudio (US), Vidyard (Canada), SproutVideo (US), Castr (Canada) and Muvi (US).

What is the total CAGR recorded for the Video Streaming Software market from 2024 to 2029?

The video streaming software market will record a CAGR of 17.5% from 2024-2029

What is the projected market value of the Video Streaming Software market?

The video streaming software market will grow from USD 13.3 billion in 2024 to USD 29.7 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 17.5% during the forecast period.

What are the significant trends in the Video Streaming Software market?

The video streaming software market is witnessing significant trends reshaping how content is consumed and delivered. With the rise of over-the-top (OTT) platforms, consumers can access a plethora of on-demand content without traditional TV subscriptions. Original content production by streaming giants is at an all-time high, driving competition and subscriber loyalty. Global expansion efforts are broadening the reach of streaming services, catering to diverse audiences worldwide. Personalization powered by sophisticated algorithms is enhancing user experiences through tailored content recommendations. Additionally, live streaming, AI integration, multi-device accessibility, and innovative monetization strategies are further driving growth and innovation in the industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

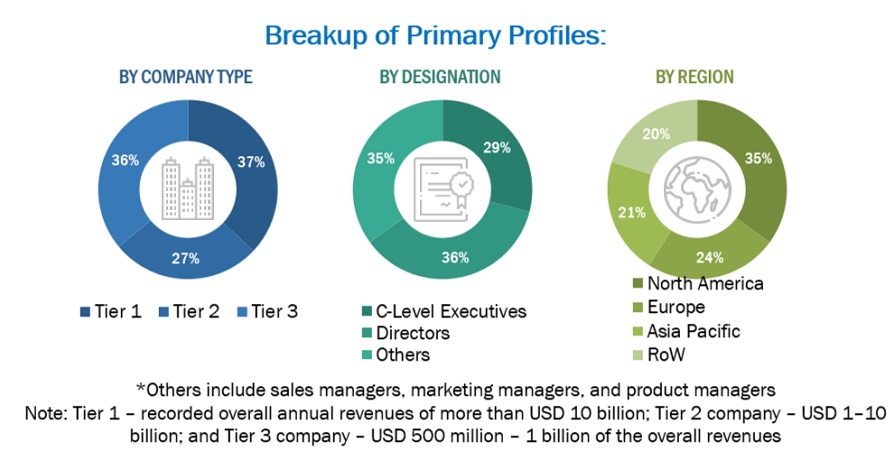

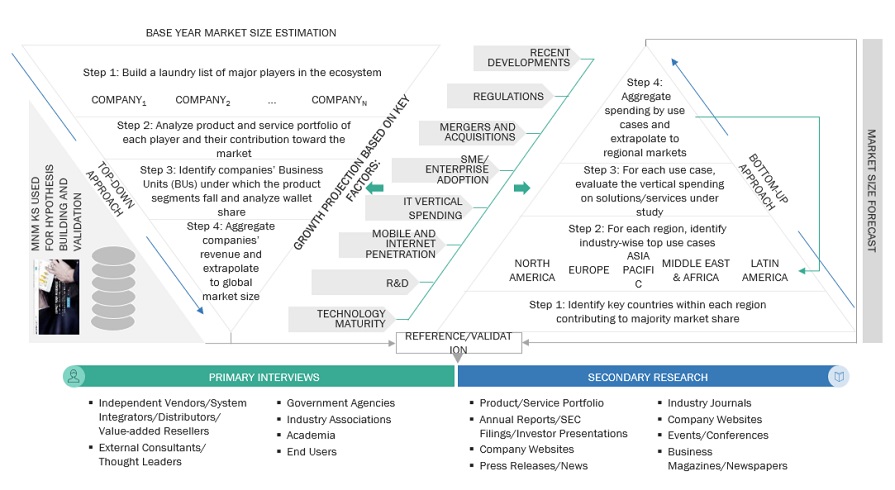

The study involved four major activities in estimating the video streaming software market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the video streaming software market.

Secondary Research

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using video streaming software solutions & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall video streaming software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the video streaming software and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the video streaming software market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Video streaming software market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the video streaming software market's demand and supply sides.

Market Definition

Video streaming enables enterprises to continuously deliver video data to a remote user over a network or the internet. A streaming provider offers various hosting options, such as on-premises and cloud-based, to meet users' needs. Video content such as TV shows, movies, and live streams is delivered on-demand or via live broadcast, usually from a cloud-based network. The video streaming software empowers enterprises to create, store, manage, monitor, and share video content across their systems for internal communication or to present the information externally to a live audience. With different streaming types, such as on-demand or live stream videos, customers can select and watch content with the help of web-based and mobile app-based delivery channels.

Key Stakeholders

- Video streaming software vendors

- Technology partners

- Consulting firms

- Resellers and distributors

- Enterprise users

- Technology providers

- Value-Added Resellers (VARs)

- End users

- System integrators

Report Objectives

- To define, describe, and forecast the video streaming software market based on offering (solutions and services), streaming type, deployment mode, delivery channel, monetization model, connected devices, verticals, and regions

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size concerning five regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the video streaming software market globally

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies across segments and subsegments.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video Streaming Software Market